Now that another month is over, I want to show you another aspect of how we budget. I’ve talked about our budgeting history, about why we switched from Mint to YNAB (and how it is wonderful), and about how we budget to zero each month. Today, I want to explain what we do at the end of the month to maximize our debt repayment.

How We Budget

For those who are new here, the tool we use for our budgeting is called YNAB (pronounced “why-nab”, short for YouNeedABudget). You can learn why we love YNAB in the links above. Take it from an extremely frugal person– it’s worth every penny. You will definitely want to take advantage of their free online classes. It will change to way you think about budgeting.

We “live on last month’s income.” It’s the fourth rule in YNAB’s methodology. It is wonderful starting out the month knowing exactly how much we have to budget. The money we earned last month is all sitting in the bank waiting for us to tell it where to go. I’ll have more details on “living on last month’s income” in a future post, but that’s a brief introduction to our budgeting style. UPDATE: You can find that post here!

Flexibility Within the Month

Even though we budget every penny at the beginning of the month, we are smart enough to know that throughout the month there will be adjustments. Expenses will pop up that we didn’t anticipate and our priorities may change. Flexibility is built in to the system. There is some give and take between categories.

We have a beginning of the month debt payment and an end of the month debt payment. After budgeting our other expenses for the month, we put a large chunk of the remaining money toward debt. The remainder sits in a category called “End of the Month Payment.”

If we decide to overspend in a budget category, or have an expense that we didn’t plan for, the money has to come from somewhere in the budget. We subtract money from a different budget category and add it to the place where need it. We try to take it from another normal budget category first, but if that doesn’t work out (if we can’t spare anything in our other categories or it’s near the end of the month and they’re already spent), we will take money from our “End of the Month Payment” category.

For example, at the beginning of May I was not planning on buying supplies for my Etsy business. Halfway through the month, I ran out of the best spray adhesive ever, which is essential. Also, when I was in town I found a sale on some of the paper and ribbon I use regularly. I spent $27.80 that I hadn’t planned on spending at the beginning of the month.

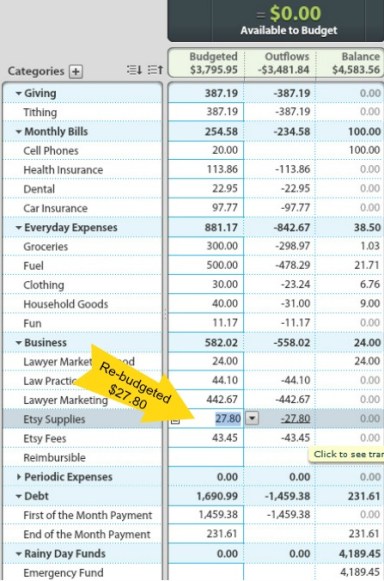

When I entered the transactions in YNAB, my budget looked like this:

Whenever there is red in the right-hand column, you can’t trust your budget. You have to do something to correct that.

I chose to subtract $27.80 from the money allocated to our end of the month debt payment. That pushed $27.80 up to the “available to budget” green number at the top.

Then I budgeted $27.80 in the budget column under “Etsy Supplies.” Now there is no more red in the balance column and the budget is happy.

That’s just one example. It’s normal for your budget to change throughout the month. In terms of YNAB’s Four Rules, this is called Rolling with the Punches.

Extra at the End of the Month

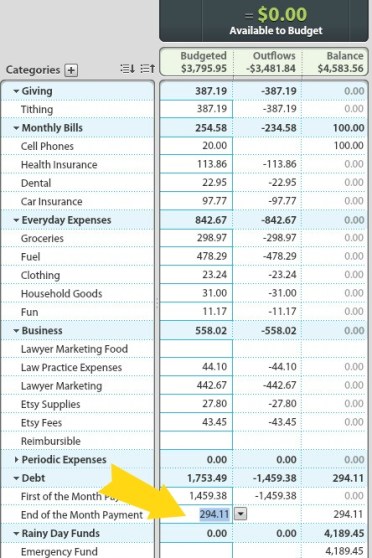

At the end of the month, we go through all of our budget categories to see how much we have remaining. I look down through the balance column and see which categories have unspent money.

For each of those categories, I change the budgeted amount (first column) to the amount we actually spent (second column) so that the balance (third column) is zero. The un-budgeted money moves up to “Available to Budget” at the top (in green). It’s always exciting to see how much we have left over!

We add this amount to the “End of the Month Payment” category, then make a loan payment in that amount.

Since our goal is paying of a hefty load of student loans, we put all the extra from our categories toward our debt. If your goals are different, you might opt to not empty the extra in your categories, but let them accrue. If you didn’t spend any of your clothing budget this month, you would have twice as much available next month.

You’ll notice that I didn’t touch the cell phone category. This is the only category that I allow to accrue. Our $10 per month cell phones are on my parent’s family plan, so I pay that money to my dad, but I don’t send him a check every month (and he doesn’t have PayPal). UPDATE: We ditched our dumb phones and got $10/month Republic Wireless smartphones, which are awesome. You can read about our switch here.

Maximizing Our Debt Payments

Before we started using YNAB, we would guess about how much we could afford to put toward debt. We would try to put as much as we could, but we had to err on the safe side because we had upcoming credit card bills that we paid in full each month. Any “extra” at the end of the month just got mixed in and lost in the scramble of moving money around and being careful to watch due dates.

Between budgeting every penny of last month’s income at the beginning of the month and putting every unspent penny toward debt at the end of the month, we are able to maximize what we pay off in debt each month. Knowing that we are putting as much as we can toward our those beastly student loans each month brings peace. We are also motivated to do our best to keep our spending down in other categories because we know it will make a difference and our efforts won’t be lost.

Some links in this post are referral or affiliate links. For more info check out my disclosure page.

I LOVE that the first thing is tithing. It’s such a blessing to see others utilize that great principle God sets forth for us. Sent this link to my husband, believing we can use this tool to further help us out of debt.

Thank you Lena. Wishing you the best in getting out of debt. YNAB has helped us tremendously!

I really am excited about this approach! My income is so variable, I was overwhelmed with budgeting, and paying the maximum on our debt possible. I like solid figures, but I also appreciate the flexability of this system. I’m interested to read your other articles on how you managed to be able to use last months income for this months budget. I’m juggling the pay check to paycheck struggle right now. however I’m sure you have some great tips.

Not only do I think this is a great system, but I really really appreciate how you laid out the steps for how you do this!

Thanks for stopping by Julie. We are really loving this system.

It’s definitely a good idea to work flexibility into your budget because you don’t always know what will come up! Last week a brake line on my car started leaking–no brake fluid means no working brakes so that’s not the kind of fix that you can wait on–so I’m glad we set aside money for unexpected extras!

Yes! It’s always the car-related expenses that are so hard to plan for. Flexibility in the budget makes handling car repair not as bad (though I still don’t like it!).

We just started the 34 day free trial – still a little overwhelmed trying to set everything up, but I’ll be taking the free classes and learning all I can so we can stop living paycheck-to-paycheck! Thanks for the information!

The classes really help. I love that they email you the links so you can watch them again when you have questions.

WOW Stephanie that is genius! Using YNAB (that I bought after a free-trial because you persuaded me!) is the best thing I ever did when we suddenly, but not unexpectedly, went down to one income. Since then I have made minimal “extra” payments towards debt, but with this method I will probably be able to free up more to do so. Thanks so much.

I’m thrilled to hear that YNAB is working out so well for you CeCee! I feel the same way. I can’t get over what a difference it makes in our budgeting and paying off our debt. There is so much less stress and anxiety for us.

This is a great way to put more toward your debt, and it could also serve as motivation to make sure to spend less in other categories if possible. I have my budget in Excel, but I do display how much is left over there. The only difference is, if we go over in one category, I don’t really move anything around. We don’t have too many categories to pull from, though. I’ll have to take another look at the end of this month!

It is definitely motivation to keep spending down. Even if you go over in one area, you can still come out ahead.

I love this information…I’ve been hearing a lot about YNAB lately, and I definitely want to get it. Hopefully over vacation, I can get some time to really research it and get everything set up!

Definitely take some time to watch the videos and play around with the trial version.

Looks like a great tool! I use an Excel spreadsheet which can be messy at times, but I work in Excel for a majority of the day, every day, so it’s a bit easier for me to use.

We are loving it!

I think that’s really smart to tweak as you go along and remove from other categories. I always beat myself up when the unexpected expenses pop up so this is great!

It is nice to not feel “beaten” when your plans change.

I love that approach – must have a look at that app in a second – because you can see exactly what you have left and what you can then add on to more payments. Are you seeing you’re being able to pay off more simple by using the budget and being more careful to not go over?

Absolutely! When I first researched YNAB, I read that people have an average turnaround of $200 in one month. I thought “yeah, but that’s for people who don’t budget at all.” I was shocked at how the methodology and software really saved us money by allowing us to better allocate and keep track of our money and stick to our plan. Tracking and being more “involved with” your money also motivates you to manage it more wisely.